Liquidity trap: A situation in which prevailing interest rates are low and savings rates are high. As a result, monetary policy is ineffective.

The effectiveness of

QE is being compromised by unwillingness on behalf of UK banks to lend. As a result, for every £1 spent on

QE, less than £1 is being lent out, which means banks are hoarding the money in order to bolster their balance sheets. This is clearly demonstrated in the charts below, which are based on weekly data from the Bank of England. The first chart shows how a large part of the

BoE's ballooning balance sheet has come from reserve balances. The second chart suggests that the cumulative Gilt purchases by the Bank of England have been responsible for the increase in commercial bank reserve balances held at the Bank.

Having initially been about increasing “the amount of money that’s held by the wider economy”, the purpose of

QE has been refined by the Bank of England to restoring M4 (ex Intermediate

OFCs) growth to 5% per

annum. Therefore, the Bank of England acknowledged in the August

Inflation Report that

QE is not meeting their 5% target:

One potentially useful diagnostic of the impact of the Bank’s asset purchases is the extent to which they boost the stock of broad money. Broad money growth remained weak in Q2. That reflected continued underlying weakness in nominal demand: nominal GDP fell by 3% in Q1, and is likely to have fallen further in Q2. Absent asset purchases, it is likely that money growth would have been even weaker.

Indeed, despite

QE, M4 is moving further away from their target...

Given the ineffectiveness of circa £150 billion of Gilt purchases to date, speculation is mounting that the Bank will resort to increasing the

QE programme to £200 billion and charging negative interest rates on reserve balances at the

BoE in order to boost the money supply and force banks to lend. This, coupled

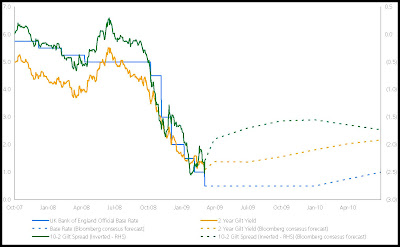

Mervyn King's prognosis of a "slow and protracted recovery", explains why yesterday the two year Gilt yield reached an all time low of 0.74%, Cable sold off two big figures and interest rate futures are pricing in low interest rates will continue for the foreseeable future…