"[Thomas] More is a man of an angel's wit and singular learning. I know not his fellow. For where is the man of that gentleness, lowliness and affability? And, as time requireth, a man of marvelous mirth and pastimes, and sometime of as sad gravity. A man for all seasons."

Robert Whittington, 1520

Attempting to construct a portfolio at the moment is at best difficult due to the uncertainty surrounding the state of the global economy. On the one hand, a protracted period of synchronised recession and deflation suggest that taking risk will not be rewarded and that investors should park their cash in safe haven assets until the economic storm has passed. On the other hand, a lot of bad news is already in the price and the size of the stimulus matches the severity of the problem, suggesting that opportunities abound and potential returns are more than commensurate with the risks.

On whichever side of the fence you sit, there is a common factor that make the risks of being wrong very painful: volatility. Investor behaviour has become bipolar, split between fear and greed. So, the bears who invest in fear assets, such as US Treasuries and gold, do so at high prices which can quickly reverse when the risk barometer turns back to greed.

The challenge is therefore to create a portfolio for all seasons. Such a portfolio should be split between fear investments that profit from a bearish outcome, and greed investments that profit from a bullish outcome.

Fear investments

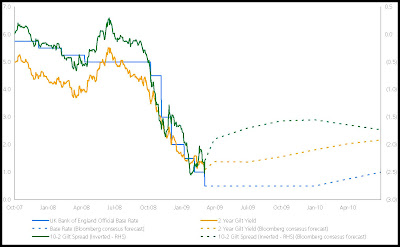

Long dated conventional Gilts are the instrument of choice to play the risk of deflation and depression. Indeed, the BoE believes so too, since they are prepared to buy £100m of them in order to stave off deflation and stimulate the economy. As discussed previously in QE in the UK, this implies a bullish flattening of the Gilt curve. Therefore, given the BoE's plans to acquire 24% of eligible medium and long Gilts in the first £75 billion tranche of QE, extending duration across the 7 to 25 year maturities is likely to best capture any fall in yields.

As for equities, if Nouriel Roubini is to be believed then:

"If a near depression were to take hold globally a 40% to 50% further fall in U.S. and global equities from current levels could not be ruled out... Earnings per share (EPS)of S&P 500 firms will be in the $50 to 60 range, but they could fall to $40. The price earnings (P/E) ratio may fall in the 10 to 12 range in a U-shaped recession. If earnings are closer to 50 or the P/E ratio falls to 10 then the S&P could fall to 600 (12 x 50 or 10 x 60) or even to 500 (10 x 50)."

Buying out of the money puts on the S&P 500 or FTSE 100 is therefore a cheap method of insuring against possible Armageddon.

For investors looking for a save haven, the US dollar remains the favoured currency. However, this notion of safety is an illusion, based on the relative attractiveness of the Dollar (see The relative illusion of USD safety). Fundamentally, the Dollar is no better off than its counterparts, however its strength lies in investor appetite for US Treasuries and forced buyers of the currency who are unable to refinance their debt. However, once the financial system shows signs of stabilising, the Dollar is likely to collapse under the weight of huge deficits, inflation and overvaluation, possibly challenging the long established Dollar hegemony. Thus, in the longer term, gold is likely to be a better store of value and in the short to medium term the Dollar is likely to continue to appreciate versus another previous safe haven currency, the Japanese Yen.

Greed investments

What if the talk of depression is overdone and if risk aversion turns to risk seeking? Fear investments will be a 'busted flush'. Admittedly, this seems unlikely, although if there is one thing that the last 18 months have taught us, it is to expect the unexpected.

Equities are the most effective and liquid way to increase risk. The freeze in credit markets is unlikely to thaw overnight, leaving corporate bonds illiquid outside of the primary market. Notwithstanding a further 10-20% cut in earnings, many markets are trading on single digit P/E ratios (e.g. FTSE 100 trading on 9.2x forward earnings & €Stoxx 50 trading on 7.9x forward earnings, which would increase to 9.8x if earnings were cut a further 20%). Moreover, many other metrics of value suggest that equities are oversold.

However, with high volatility the risk of investing too early or all out depression means that being wrong can result in significant losses. Options are therefore an effective way of playing any potential rally in stock prices, since they allow the investor to participate in the upside with leverage and the downside is limited to the loss of one's premium.

Given that risk aversion is now a consensus trade, any bad news would have to get even worse in order to affect the price of safe haven assets. If the situation improves or, at least does not deteriorate further, a mass exodus from safe haven assets is possible. This has clear implications for the US dollar and US Treasuries, the biggest recipients of safe haven flows, both of which could see a sharp unwind if risk appetite returns. Indeed, at his annual press conference, China’s Premier Wen noted:

"We have lent a huge amount of money to the U.S., so of course we are concerned about the safety of our assets. Frankly speaking, I do have some worries."

The risk reward trade-off for shorting the Dollar and US Treasuries have therefore improved and any collapse in the Dollar will more than likely support the gold price.

A combination of short Dollar, short US Treasuries and long gold also happens to be an effective hedge against a wildcard, inflation. The further interest rates fall in the shorter term, the greater the risk of inflation in the medium to longer term. Thus, at some point, assuming the stimulus has the desired effect of reflating the economy, inflation will rise again. Moreover, given that the stimulus has been funded by record amounts of government borrowing, yields are likely to respond in kind to both rising inflation and issuance as investors demand a higher risk premium. Indeed, it is possible that governments and central banks may want to induce a period of above target inflation in order to reduce the public and private debt burden. For now, the market is concerned about possible deflation and breakeven inflation rates have fallen to levels that make insuring against inflation attractive.

Conclusion

A portfolio for all seasons is therefore characterised by fearful greed, where asymmetrical payoffs are expressed in the main via out of the money options whose downside is limited to the loss of premium and upside is unlimited. Given the high levels of asset price volatility and leverage built into options, risk management is essential. Setting a risk budget, using a VaR limit, ensures that portfolio risk is kept within acceptable levels.

Finally, the ideas expressed in this note have been expressed in an illustrative £1 million portfolio, which began 1st March. Performance will be monitored on a monthly basis, net of a total expense ratio of 2%. Capital and risk allocation are divided between four 'buckets': interest rates, FX, equity & cash (see current capital allocation below). The portfolio is already performing well, up 11.8% with most of the P&L coming from 5-15 year Gilts, FTSE 100 puts and FTSE/ Xinhua 25 calls.