Bullish: Falling interest rates, deflation, quantitative easing (QE), flight to safety = bullish flattening for yield curves (see Japan below)

BoE Jan minutes show MPC unanimously agreed that Mervyn King, governor, should seek authority for purchases of gilts and other securities in an effort to broaden the money supply. The Bank of England believes that inflation will undershoot the target until 2012 unless it engages in quantitative easing. Implementation rumoured £10-15bn over next 3 months.

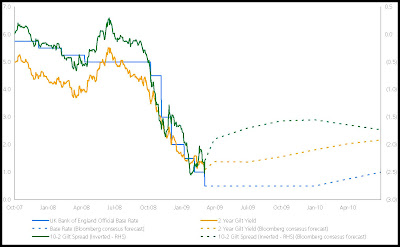

Barcap revised Bank of England rate view & expect Bank rate to be cut by 50bp at the March meeting to 0.50% then leave policy rates unchanged as it embarks on a programme of QE. Barcap no longer expect a back-up in gilt yields (forecast bottom @ 3.25% Q3 '09 vs. Bloomberg consensus 3.13%) in the second half of 2010. Barcap expect any tightening cycle commencing in 2011 to be relatively cautious.

China held $696bn of US Treasuries in Dec 08. Luo Ping, a director-general at the China Banking Regulatory Commission, said that China would continue to buy Treasuries in spite of its misgivings about US finances: “Except for US Treasuries, what can you hold?” he asked. “Gold? You don’t hold Japanese government bonds or UK bonds. US Treasuries are the safe haven. For everyone, including China, it is the only option… We hate you guys. Once you start issuing $1 trillion-$2 trillion… we know the dollar is going to depreciate, so we hate you guys but there is nothing much we can do.”

Bearish: Risk premiums very low – return-free risk – don't adequately compensate investors for risks: CPI & record issuance. Turning a blind eye to fundamentals or risk, is a good indicator of a bubble.

Increased issuance will put pressure on FX & yields (e.g. US 10yr +1% YTD on record issuance announcement). However, a degree of inflation is beneficial, since it will reduce the debt burden

In recent years, demand for US government debt has been stoked by developing countries running huge trade surpluses with the US and recycling dollars by buying Treasuries. However, many are facing growing pressure to stimulate their own economies and are seeing their current account surpluses decline as global demand diminishes.

Index linked markets attractive (despite recent rally in BEIs) as only LT risk free asset. Whilst deleveraging in the short term ≠ CPI. However, the further interest rates fall in the short term, the greater the risk of inflation in the medium to long term. Thus, at some point, assuming the stimulus has the desired effect of reflating the economy, inflation will rise again, possibly in an aggressive manner. Moreover, given that the stimulus is funded by record amounts of government borrowing, yields are likely to respond in kind to both rising inflation and issuance as investors demand a higher risk premium. Indeed, it is possible that governments and central banks may wish to induce a period of above target inflation in order to reduce the public and private debt burden.

UK 10yr BEI 2.1% = just over BoE CPI target & risk to upside.