Having received approval from the Chancellor to begin quantitative easing, the MPC voted to begin a programme of asset purchases of £75 billion over three months via the Asset Purchase Facility. This represents the first tranche of an overall £150 billion sanctioned by the Treasury for purchasing of £50 billion of private sector assets (CP & corporate bonds) and up to £100 billion of Gilts, as requested by Mervyn King in recent letter to Chancellor:

"In order to facilitate an expansion of the monetary base through the Asset Purchase Facility, the MPC proposes that gilt-edged securities be added to the list of eligible assets set out in your letter of 29 January. I suggest that the MPC be authorised to use the facility to purchase eligible assets financed by central bank money up to a maximum of £150 billion but that, in line with the current arrangements and in recognition of the importance of supporting the flow of corporate credit, up to, £50 billion of that should be used to purchase private sector assets… If the facility were to be used for monetary policy purposes, I envisage that the Committee would vote each month on a resolution concerning the asset purchases it deemed necessary to meet the inflation target."What are the implications for the Gilt market? More specifically, which part of the Gilt curve will be impacted most and how does the size of the programme compare to the value of outstanding Gilts?

In their press release, the Bank of England indicated that the majority of the first £75 billion will used to buy Gilts. Purchases will target medium (7-15 year maturities) and long (15+ year maturities) conventional Gilts, as defined by the Debt Management Office (DMO).

The nominal value of all outstanding conventional Gilts is £543.9 billion. The market is segmented between £233.7 billion (43%) in short Gilts, £107 billion (20%) and £203.2 billion (37%) in long Gilts. The first tranche of £75 billion therefore represents 24% of the universe of eligible Gilts of £310.2 billion. The full £100 billion sanctioned for Gilt purchases represents 32% of medium & long Gilts and 18% of the overall Gilt market.

The size of the initial tranche of £75 billion is also substantial in relation to forthcoming net Gilt issuance, representing 58% of the £130 billion expected in the current financial year. Furthermore, the chancellor confirmed that current debt management policy remains in place and there are no plans to change it in light of quantitative easing.

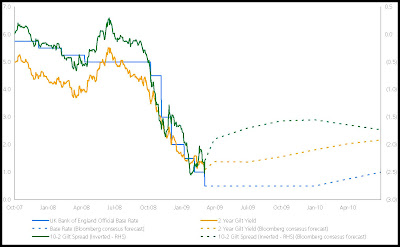

The size of Bank's quantitative easing programme is therefore significant and will have a sizeable impact on the Gilt market. Indeed, the initial 40 basis point rally in 7 to 30 year Gilts following the announcement reinforces this. Going forward, it is likely therefore that the Bank of England's operations will result in a bull flattening of the Gilt curve, as long yields converge on shorter yields. Bull flattening is not only consistent with the Japanese experience of QE in the 1990's, but it has become the consensus forecast for the Gilt curve, as the chart below demonstrates.

No comments:

Post a Comment